Your advisor at BforBank has just warned you about a check that is about to be rejected? Find out in this article everything you need to know about rejected checks at BforBank.

Summary

Why a bounced check at BforBank?

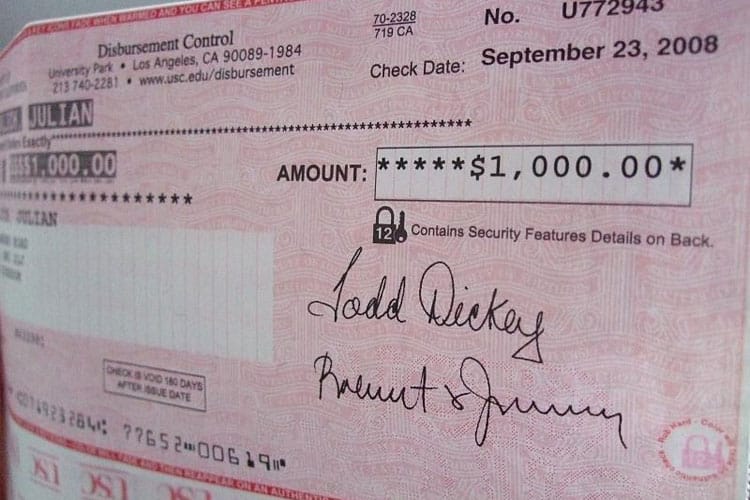

A rejected BforBank check occurs when you have issued a check, but you do not have the necessary funds in your bank account to ensure its collection by your beneficiary. In this specific case, BforBank is obliged to refuse payment of the check when it is about to be cashed. This lack of provision to honor the payment of one or more checks, however, has serious consequences. Moreover, just for the rejection of the check, you will have to pay fees, which are of the order of 30 euros for checks of an amount less than or equal to 50 euros, and 50 euros for checks of a higher amount. . Lack of funds is not, however, the only reason why BforBank reserves the right to reject your cheque. Indeed, your bank account may have been closed before the check was cashed. Once your account has been closed, while a cashing in your account occurs, no more banking transactions are possible. It is then most logical that the check is rejected. Your FCC registration with the Banque de France no longer gives you the right to use a checkbook as a means of payment. Until you have settled your old unpaid checks, you will not be able to pay by check as well.

The possible consequences of a rejected check at BforBank

Your advisor at BforBank has just informed you of a bounced check and you are wondering what to expect in this case? If the rejection was caused by the lack of funds in your bank account, you may become banned from banking. Indeed, when a check is rejected for lack of provisions, the bank declares the payment incident to the Banque de France. Which makes you appear FCC or Central Check File. You will no longer be able to make payments by check until you manage to settle the payment of this unpaid check. Another measure that can be taken by BforBank is the cancellation of your overdraft authorization. Your authorized overdraft is no longer available until you clear NSF checks. At Bforbank, in the event of a rejected check, you will no longer be entitled to benefit from a loan or a cash advance. All credit applications at Bforbank are rejected, whether for a home loan or for a consumer loan. In addition to this systematic refusal of any credit application at Bforbank, you are also obliged to pay bank charges which will be debited from your account. To avoid other worries, it is also preferable to know how to properly fill out a check.

What to do in case of bounced check at Bforbank

When your adviser contacts you about a possible rejected check, first of all know that you have a predefined period of time to regularize the check before it is definitively rejected. According to the regulations in force, you have a period of 7 days to fund your account and thus be able to pay for the cashing of your check. After funding your Bforbank bank account, you can ask your beneficiary to return to their bank branch to resubmit the check. You even have the possibility of notifying the prioritization of the payment at Bforbank to regularize your situation as quickly as possible. Other solutions, such as requesting the amount of the check to be debited from your account and subsequently blocking it in an escrow account, are also practical in this type of situation. However, you can also recover the unpaid check and make payment by another means of payment, such as with your credit card, by bank transfer or in cash.

Discover our advice on how to deposit a check at BforBank.